Despite the prominence of Netflix, Prime Video, and Showmax, Nigerian filmmakers have lately set their sights on YouTube distribution. The list of Nollywood film TV channels on YouTube is endless: Omoni Oboli TV, Ruth Kadiri TV, Bimbo Ademoye TV, Sandra Okunzuwa TV, Emem Isong’s Royal Arts TV, Oluchi Afondu TV, Faith Duke TV, and Uche Nancy TV, to name a few. And even more names are joining the list. For instance, Gangs of Lagos producer Jade Osiberu launched a YouTube channel with her debut Isoken (2017) as the inaugural film, racking up 35,000 views within 4 days of release.

Similarly, social media influencer Enioluwa Adeoluwa released his producer debut All of Us directly to YouTube, scoring an aggregate view of 3.2 million in less than 2 weeks. It does not end there. In September, Nollywood actress Bimbo Ademoye took to Instagram to announce that in 2024 alone, she had garnered a record-breaking 27-million-plus views on her YouTube TV channel. This is no surprise, as her first film, Last Straw, had 8.3 million views in its first month on YouTube. What makes this figure even more outstanding is that Ademoye produced only four films on YouTube this year- Unexpected Places, Last Straw, Ruse and Shining Star.

This craze for YouTube productions raises two major questions: Why are Nollywood filmmakers suddenly leaning towards YouTube? How does the Nigerian audience feel about this?

Nollywood filmmakers stand to gain quite a lot from YouTube, the 2nd most-visited website in the world (after Google Search). Statistia’s data reflect a projection of 10 million Nigerian YouTube users by the end of 2024. Contrastingly, there are 25,000 Nigerian Netflix users, and 1,199,661 Nigerian cinema-goers in the first half of 2024. The maths tell us that Nigerian filmmakers can secure a wider reach by distributing their films on YouTube.

YouTube’s algorithm poses another benefit to Nollywood filmmakers: It relies heavily on real-time audience engagement—views, likes, comments, shares—and tends to promote content that gains traction quickly. This allows for organic viral growth where videos can blow up based on high interaction, regardless of production scale. Filmmakers can interact directly with their audience, build a community, and leverage that interaction to enhance visibility and relevance. On the other hand, streamers such as Netflix, Prime Video and Showmax’s algorithm focuses on promoting content within its catalogue, and content from smaller creators might not get the same level of promotion as larger, headline shows or movies.

Also, On YouTube, films can be shared outside of the platform, embedded on websites, and linked on social media, allowing for discovery by non-YouTube users as well. Plus, filmmakers can use SEO-friendly descriptions and keywords, making it easier for audiences to find their films through search engines. The algorithm of Netflix, Prime Video and Showmax only works within the app for existing users, meaning content can’t be watched unless you are already a paying subscriber.

In addition, YouTube offers filmmakers direct control over their content distribution, allowing for flexible monetization options (advertisements, sponsorships, super chats). Filmmakers can upload videos and instantly begin earning revenue, even on smaller scales. Though the ad revenue from Nigerian viewers may be limited, filmmakers can target audiences in foreign countries, where ad rates are higher. The prospect of earning in U.S. dollars makes YouTube attractive to Nigerian filmmakers. In fact, a Nollywood filmmaker once revealed that he once made a 1 million naira ($1,200) budget film and received $3,500 in his first check from YouTube. With Netflix, Prime Video and Showmax, revenue is typically tied to the initial deals, not real-time audience engagement.

Lastly, YouTube reduces the rate of piracy, a major setback to the distribution of Nollywood films. With Subscription Video on Demand (SVOD) platforms such as Netflix, Prime and Showmax, films and shows have to be streamed in-app. Also, downloading these films on phones or laptops might be difficult, especially with a platform like Netflix limiting the number of devices that an account user can download films on. As a result, many Nigerians download films from pirate websites such as Nkiri, Net Naija, and even on Telegram channels. However, with YouTube, an extension can be added to a viewer’s device, allowing for films to be downloaded directly to a device. In addition, YouTube allows for picture-in-picture display, which means that many viewers can use other apps while watching a film on YouTube. To see a film on YouTube, there would be hardly any need to stream or download from a pirate site, as doing so would require almost the same effort as streaming on YouTube.

While filmmakers are reaping the rewards of YouTube, we mustn’t overlook the potential effects on Nigerian audiences as they transition from traditional cinema and big-name streaming services. To better understand audience preferences between free accessible platforms like YouTube and paid services such as Netflix and Prime, a survey was conducted with 40 random audience participants in Nigeria.

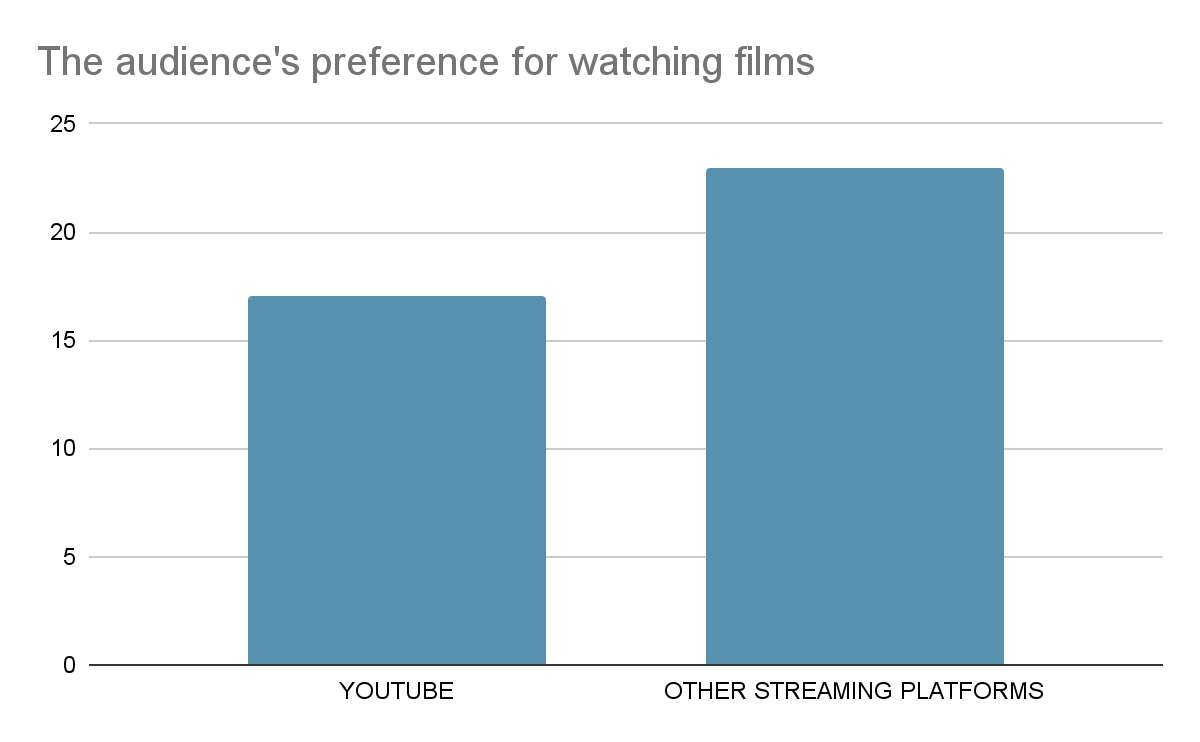

Of the 40 respondents, 23 indicated a preference for seeing films on Netflix and Prime, while 17 preferred YouTube.

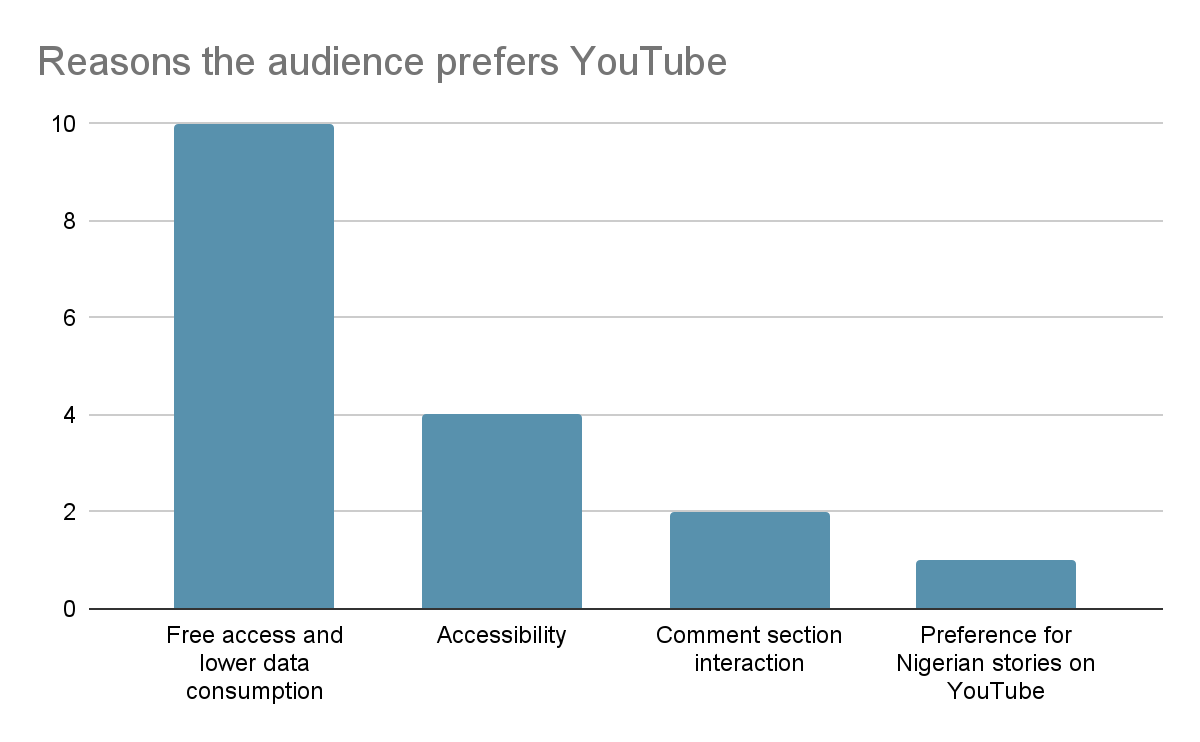

Those who favoured YouTube highlighted key reasons for their choice. 10 respondents cited YouTube’s free access and lower data consumption as their reason, while 4 stated that accessibility was important. 2 of the 17 found value in the interactive nature of YouTube’s comment section, while the 17th participant emphasised a preference for Nigerian stories on YouTube, particularly those by Ruth Kadiri, Omoni Oboli, and Bolaji Ogunmola.

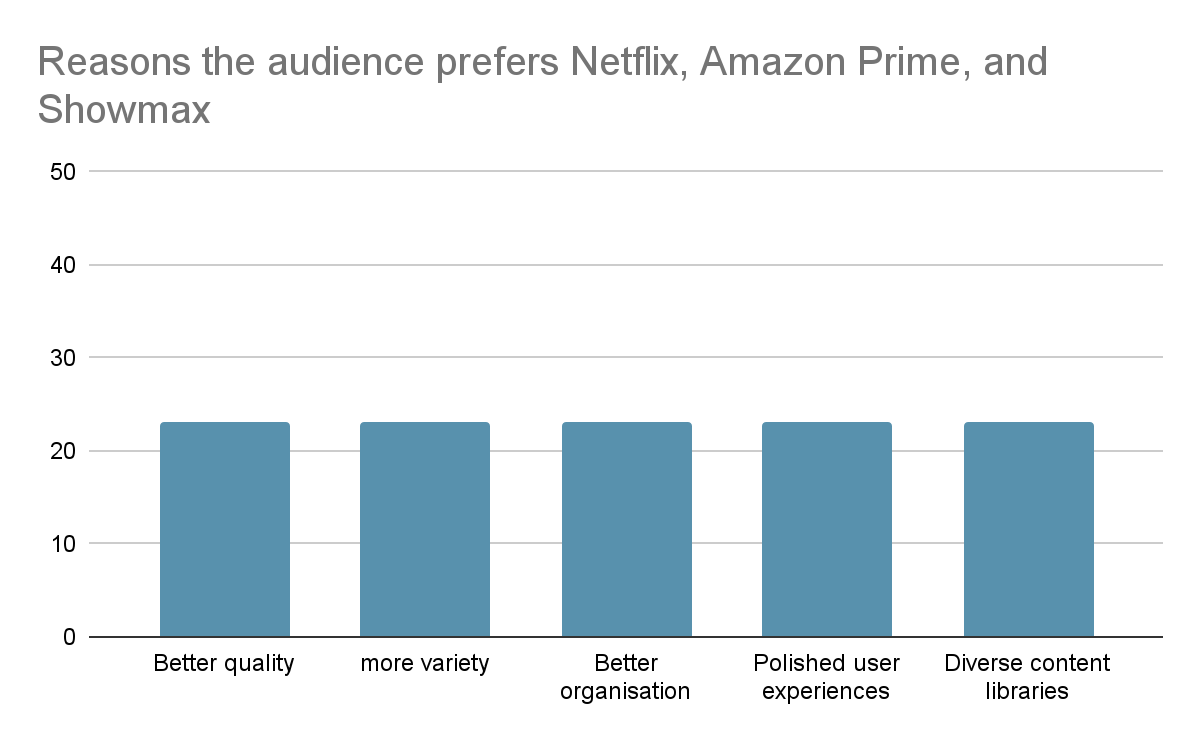

In contrast, the 23 respondents who prefer Netflix, Prime Video and Showmax universally agree that these platforms offer better quality, more variety, and a higher degree of organisation. They appreciate the diverse content libraries and polished user experiences available on paid platforms.

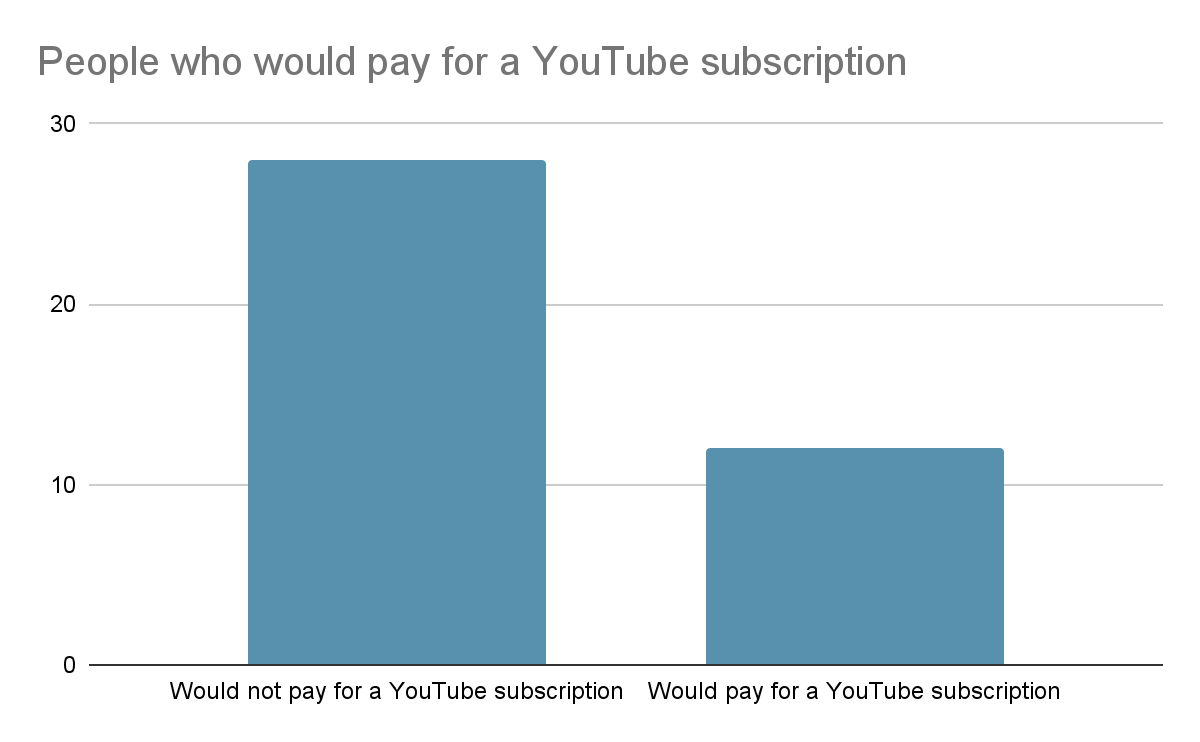

When the participants were asked if they would consider subscribing to YouTube as a paid service, a significant majority—28 out of 40 —said they would not pay for a YouTube subscription.

Among these 28, 3 respondents insisted that YouTube should remain free, while 5 mentioned financial constraints as their reason. 2 respondents expressed a lack of interest in YouTube films in general, and the remaining 18 said they simply preferred the quality and variety on Netflix and Prime. On the other hand, 12 of the 40 respondents indicated that they would consider subscribing to YouTube if it introduced a paid model, although they were in the minority.

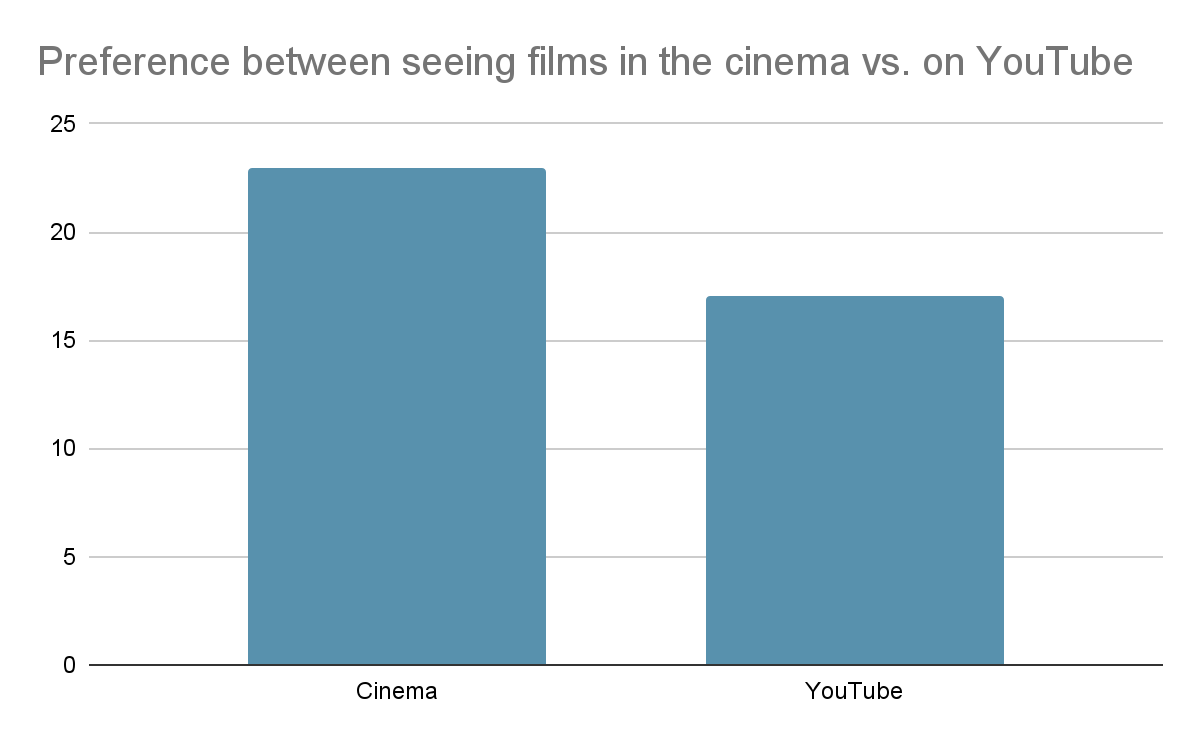

Another aspect of the survey explored audience preferences between watching films on YouTube versus going to the cinema. The responses were nearly split, with 17 respondents preferring YouTube due to the comfort of watching at home and the avoidance of transportation and ticket costs. Meanwhile, 23 respondents preferred the cinema, citing the immersive experience of the big screen, the opportunity for interaction with other viewers, and the superior film quality. 2 respondents who favoured the cinema also mentioned an additional frustration with YouTube, noting the disruptive ads, lower quality, and network issues that can detract from the viewing experience.

A valid conclusion from the survey is that majority of the 40 Nigerian audience participants would rather see films in the cinema and on paid streaming platforms than on YouTube. This conclusion leads to further inquiry. If, for instance, a study were to be carried out on 1,000 or 200,000 Nigerian audience participants, would the same preference for cinema and paid streaming platforms be reflected? A lot of research needs to be carried out to provide answers to this question.

The absence of comprehensive data on Nigerian audiences’ perspectives regarding the shift to YouTube underscores the tendency to overlook audience needs in industry decision-making. As previously discussed, Nollywood’s profit-driven focus is rooted in quantifiable metrics; yet, while data is available on the number of Nigerian YouTube users, cinema-goers, and Netflix viewers, there remains a notable gap in understanding the audience’s true preferences. Despite this gap, Nollywood filmmakers still seem to be profit-driven rather than audience or customer-driven. This drive fuels the YouTube craze, and raises many questions. Is Nollywood just moving in circles, jumping from one trending distribution channel to the next? Is that a sustainable approach? When will a proper structure be established? In a few years, will something new replace the YouTube craze?

It was once said that Netflix is eating Nollywood’s lunch. This year, it looks like Netflix has passed the spoon to YouTube, and Nollywood’s lunch is still on the table.

Share your thoughts in the comments section or on our social media accounts.

Keep track of upcoming films and TV shows on your Google calendar.

3 Comments